All Categories

Featured

Table of Contents

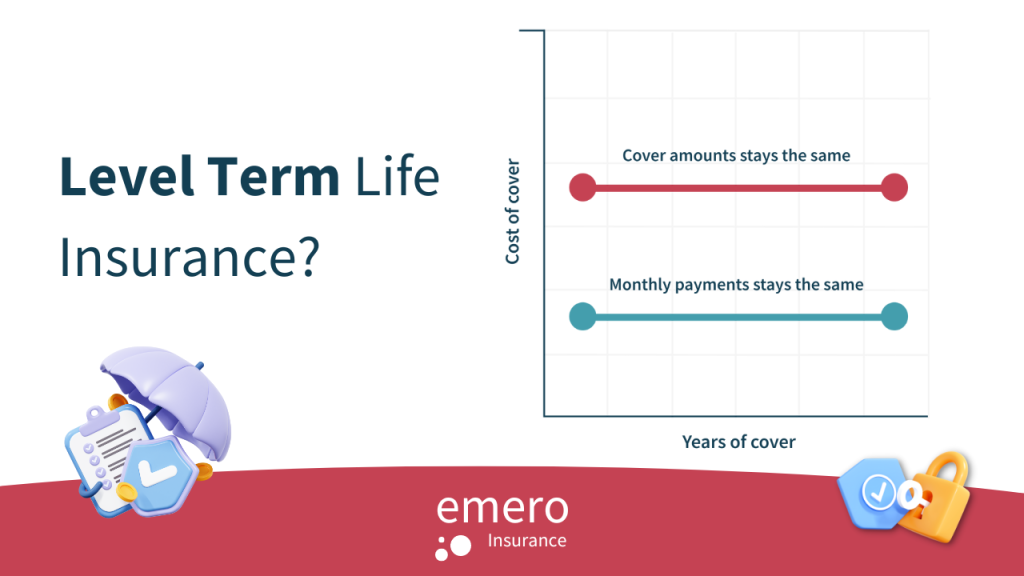

It allows you to spending plan and plan for the future. You can quickly factor your life insurance into your budget plan because the premiums never change. You can plan for the future simply as easily since you understand exactly just how much cash your loved ones will get in the event of your lack.

In these situations, you'll usually have to go through a new application procedure to get a much better rate. If you still need coverage by the time your degree term life policy nears the expiration date, you have a couple of options.

The majority of level term life insurance coverage plans come with the option to renew insurance coverage on a yearly basis after the first term ends. does term life insurance cover accidental death. The price of your policy will be based on your existing age and it'll enhance annually. This could be a good option if you just require to expand your coverage for 1 or 2 years otherwise, it can get expensive pretty swiftly

Degree term life insurance policy is one of the most affordable protection options on the market since it uses standard defense in the kind of survivor benefit and only lasts for a set amount of time. At the end of the term, it ends. Whole life insurance policy, on the various other hand, is substantially much more pricey than degree term life because it doesn't run out and includes a cash worth function.

Effective Level Premium Term Life Insurance Policies

Rates might differ by insurance provider, term, coverage amount, health and wellness class, and state. Not all plans are available in all states. Rate illustration valid since 10/01/2024. Level term is a terrific life insurance policy choice for lots of people, yet depending upon your protection requirements and individual situation, it might not be the most effective suitable for you.

This can be an excellent alternative if you, for instance, have simply stop cigarette smoking and need to wait two or three years to use for a degree term plan and be qualified for a reduced price.

Cost-Effective Term Vs Universal Life Insurance

With a lowering term life policy, your survivor benefit payout will certainly reduce with time, but your settlements will certainly stay the very same. Decreasing term life policies like home mortgage defense insurance coverage normally pay to your lending institution, so if you're looking for a policy that will pay out to your liked ones, this is not a great fit for you.

Enhancing term life insurance policy plans can aid you hedge against rising cost of living or plan economically for future children. On the various other hand, you'll pay even more in advance for less insurance coverage with a raising term life plan than with a level term life plan. If you're uncertain which kind of policy is best for you, working with an independent broker can aid.

Once you've made a decision that degree term is appropriate for you, the following step is to buy your plan. Right here's how to do it. Determine exactly how much life insurance policy you require Your insurance coverage amount need to provide for your family members's long-term economic demands, consisting of the loss of your earnings in the event of your fatality, in addition to financial obligations and day-to-day expenses.

A degree costs term life insurance strategy allows you adhere to your spending plan while you aid shield your family members. Unlike some tipped price strategies that enhances annually with your age, this kind of term strategy offers rates that stay the same through you choose, also as you obtain older or your health changes.

Find out more concerning the Life Insurance coverage choices readily available to you as an AICPA participant. ___ Aon Insurance Coverage Solutions is the trademark name for the broker agent and program management procedures of Affinity Insurance policy Solutions, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Affinity Insurance Policy Company, Inc. (CA 0795465); in OK, AIS Fondness Insurance Providers Inc.; in CA, Aon Affinity Insurance Policy Services, Inc.

Best Term Life Insurance With Accidental Death Benefit

The Strategy Agent of the AICPA Insurance Depend On, Aon Insurance Services, is not affiliated with Prudential. Team Insurance policy coverage is issued by The Prudential Insurer of America, a Prudential Financial business, Newark, NJ. 1043476-00002-00.

Table of Contents

Latest Posts

Online Funeral Cover

Life Insurance Vs Funeral Insurance

Burial Coverage

More

Latest Posts

Online Funeral Cover

Life Insurance Vs Funeral Insurance

Burial Coverage